The Hotelification of Real Estate. After the technological revolution triggered by COVID-19, people, places, and businesses have become more interconnected than at any point in human history. Now, business hotels that have been unchanged for decades will need to adapt and evolve.

After the technological revolution triggered by COVID-19, people, places, and businesses have become more interconnected than at any point in human history. Now, business hotels that have been unchanged for decades will need to adapt and evolve.

In about 10 years, buildings shall be fully automated and offer personalized experiences so as to support our increasingly on demand lifestyles. Workplace design will be adapted from compartmentalized to a collaborative, open, and flexible environment without hierarchical distinctions. Besides, corporations will need to adjust their outlook, management style, and workplace amenities to better motivate and retain top talent.

We’ll see a total integration of work, life and play into a single place, with countless options for individual personalization. The interaction between people and buildings will change—with buildings anticipating and instantaneously responding to the needs of people who occupy them. Environmental standards will become fundamental, and the value of a property will be perceived as much more than the price per square meter.

Employers will have to offer a wide variety of working locations that are flexible enough to meet their employees’ personal and professional needs. This is a big leap from the rigidity of limiting employees to a single location and putting the burden on them to make that location fit their life. Thus, the new work model will require productive flexible spaces to be available near fitness centers, malls.

The big win as an experienced operator is creating a bond between and adding value for all parties. The result will be that flexible workspace grows to at least 20% of the office market in the next decade. Most organizations will understand what portion of their portfolios is best suited for long-term committed space vs. flexible space.

Eventually, a new and more collaborative business model will emerge in which landlords, tenants, and flex space providers work closely together to create the right win-win-win outcomes for all.

The ‘Hotelification’ of Real Estate

Branded live, work & play places are ready to have their moment.

“Hotelification” is the reinvention of residential, retail, and office space based on inspiration from the hospitality industry; this trend is shaking up real estate’s business-as-usual model. Global players are offering branded and customized spaces for an increasingly mobile population of international knowledge workers who want spaces that offer a variety of short-term facilities from living and working to events, to shared restaurant tables, among others.

Benefits of Hotelification

The hotelification movement represents an intersection of several different trends, all expected to strengthen in the near future. Notably, the rise of the tech-based marketplace for home stays has forever changed the hospitality landscape, producing 6 million new rooms worldwide in a single decade. The sector of alternative accommodations, including short-term rentals and apartment-style hotels, generated more than US$ 127 billion in worldwide revenue in 2018.

The New Boomtowns

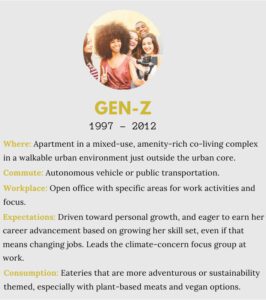

Very soon, Generation Z will start inheriting (and changing) the economy.

Urban populations are booming, and cities are struggling to improve housing, transit, and environmental sustainability. London is estimated to have 2.06 million inhabitants of Generation Z living in the city by 2030. In this new populational scenario, “Multifamily” will take center stage in real estate investment. The term “multifamily” refers to apartment blocks or campus-style developments in single ownership with market-level rents and professional management. Such properties provide favorable investment returns.

To meet this new demand, institutionally owned multifamily rental housing will account for one-fifth of global investment volume, and cross-border capital will help power the shift. In 2018 alone, US$38 billion of cross-border capital was allocated to residential, accounting for more than 10% of total cross-border investment volume. Residential investment across Europe, including the U.K. and Ireland, totaled US$58 billion in 2018, up from just US$5.5 billion in 2010.

Multifamily models across the globe have the potential to make real progress in meeting global housing needs. Global expansion of the multifamily sector can attract persevering long-term investors.