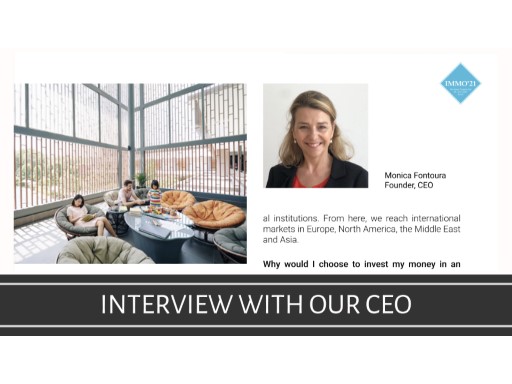

Interview with our Founder and CEO, Monica Fontoura

Interview for the IMMO’21 Swiss Property Fair Hotel investments for a better time after the pandemic.

Hotel investments for a better time after the pandemic

We are a Swiss hotel brokerage and advisory company. Alpinea sources hotel real estate assets by consulting with hotel property owners, partners or investors and presents these projects off-market to Swiss and global investors for acquisition.

You just mentioned projects “Off-market”, can you explain what this means?

Sure. This is basically about privacy and confidentiality. Normally no hotel owner wants to disclose that his hotel is for sale, for several reasons: staff can get discouraged, customers may think that it has problems, and the asset price goes down. On the other hand, investors or organizations that want to buy a hotel may not want to advertise it openly. That is why both sellers and buyers use the off-market sales channel, where confidentiality is ensured and only when the transaction is made do they choose whether to make it public.

Why should a Hotelier choose you, I mean, what makes Alpinea different from other commercial real estate agencies?

We really are specialists in this industry and know how to evaluate a hotel beyond its balance sheet. I trained in hospitality at the Glion Institute of Higher Education, and our collaborators are all experienced in this field. Being in Switzerland also means relationships with credible financial institutions. From here, we reach international markets in Europe, North America, the Middle East, and Asia.

Why would I choose to invest my money in an off-market hotel?

Because now is the right time to find opportunities for great future profitability which will also bring social and economic sustainability at a local and global level.

What was the real impact of the pandemic on your business?

Huge. On one hand, the number of available properties has grown significantly, and we’ve had to grow our team as well, also to support independent hotels, which often do not know how to reach investors. We have worked hard in 2020, and it is nice to see how we are being recognized internationally in this market as a serious and reliable partner.

Where do you see your company in the future?

I want Alpinea to continue bridging the gap between the hospitality and the finance and wealth management services industry. There’s a huge opportunity here, and I think hospitality has much to offer to investors. People still want to come together, to travel and experience the world. This year we’ve learned how important that is to us. So, in the post-pandemic world, I’m sure there will be a period of fast growth, where resources that are now sitting idly on the side will be looking for areas of investment. Alpinea will be ready to help those resources come to the hospitality industry.

ALPINEA AG

Stücki Village

Hochbergerstr. 70

4057 Basel

T +41 (0)61 564 07 40